Homeownership is a foundation of the Pursuit of happiness, however for the overwhelming majority Local American families, getting to reasonable lodging can be a test. The US government perceived these boundaries and presented the Section 184 Tribal Loan program to make it more straightforward for Local Americans to purchase homes. This loan program is intended to offer wicked good installments, adaptable endorsing, and different advantages explicitly custom-made to Local American borrowers. In this article, we will investigate all that you really want to be familiar with the Section 184 Tribal Loan, from qualification prerequisites for its extraordinary potential benefits and how it has assisted Local American people group with accomplishing homeownership.

What Is the Section 184 Tribal Loan?

The Section 184 Tribal Loan is a novel home loan program laid out by the U.S. Branch of Lodging and Metropolitan Turn of events (HUD) in 1992. Its main role is to give reasonable home supporting to Local Americans, Gold country Locals, and Local Hawaiian families. The program perceives that Local Americans frequently face difficulties while attempting to acquire customary home loans, especially assuming they live on tribal land or in underserved regions where regular funding might be scant.

Designed for Local Communities: Dissimilar to regular home loan loans, the Section 184 loan program explicitly takes special care of Local American people group. It permits clans, people, and assigned lodging specialists to exploit abject installments and great loan terms, even in regions where other funding choices might be restricted.

Government-Upheld Loan: The Section 184 Tribal Loan is supported by the central government, and that implies moneylenders are more ready to offer loans to people who could somehow battle to qualify. Since the national government ensures these loans, banks face less gamble, making it more straightforward for Local American borrowers to get to funding.

Purpose: The loan can be utilized for various purposes, including buying a current home, constructing another home, restoring a property, or renegotiating a current home loan. With these adaptable choices, the program addresses the issues of a large number of borrowers hoping to accomplish or keep up with homeownership.

The Section 184 Tribal Loan program is something beyond a monetary device — it is a basic asset in enabling Local American families to get steady lodging and put resources into their future.

Who Is Qualified for the Section 184 Tribal Loan?

Qualification for the Section 184 Tribal Loan is restricted to Local Americans, Gold country Locals, Local Hawaiians, and clans or lodging specialists serving these networks. The loan program was intended to guarantee that people from these gatherings approach reasonable lodging choices in regions where customary home loan loans may not be promptly accessible.

Individuals and Families: In the event that you are a Local American or Gold country Local who meets the program’s qualification rules, you might have the option to apply for a Section 184 loan. You should be an enlisted individual from a governmentally perceived clan. Moreover, the program is accessible to Local Hawaiians through a comparative drive known as the Local Hawaiian Lodging Loan Assurance Program.

Tribal Lodging Authorities: Clans and their lodging specialists are additionally qualified to take part in the Section 184 program. This permits clans to assemble or restore homes for their individuals, frequently involving the loans to fund lodging improvements in regions that would somehow be challenging to access through conventional moneylenders.

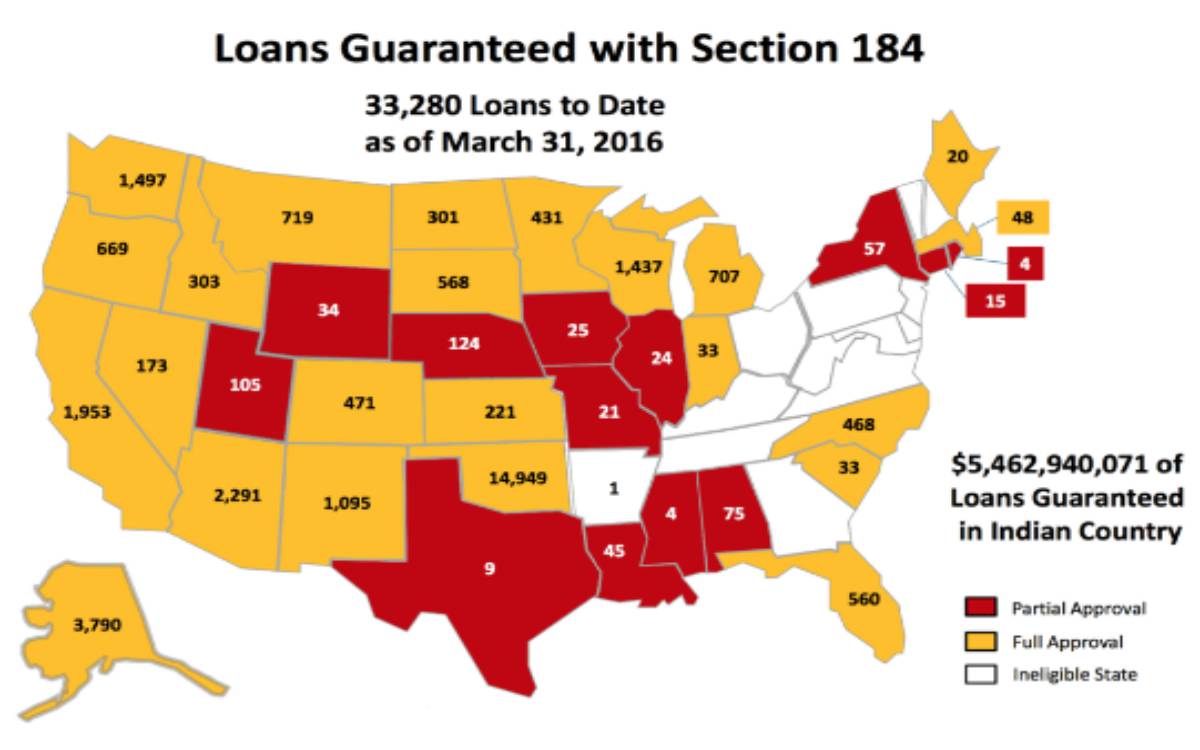

Location Requirements: The Section 184 Tribal Loan program is accessible in every one of the 50 states, yet it is especially valuable for those residing on tribal land or in assigned Indian reservations, which might not have similar admittance to customary home supporting choices. Notwithstanding, even Local Americans living in metropolitan or rural regions can exploit the program on the off chance that they meet the other qualification prerequisites.

Qualification for the Section 184 loan did not depend using a credit card score alone, which can be gainful for borrowers who might have lower credit or contemporary records. The program’s adaptable guaranteeing rules make it open to additional people and families inside Local American people group.

Key Advantages of the Section 184 Tribal Loan

The Section 184 Tribal Loan program offers a scope of advantages that make it an appealing choice for Local American homebuyers. These benefits are explicitly intended to address the exceptional monetary difficulties looked by numerous Local people group, guaranteeing that homeownership turns into a feasible objective for additional people and families.

Low Down Payment: One of the main boundaries to homeownership is the up front installment. With standard mortgages, initial installments can be pretty much as high as 20%, making it challenging for some first-time purchasers to manage the cost of a home. The Section 184 loan requires a much further initial installment, normally as low as 1.25% for loans under $50,000 and 2.25% for loans over that sum. This diminished prerequisite makes it more straightforward for Local American families to buy a home.

Flexible Credit Requirements: The Section 184 Tribal Loan program is more merciful with regards to FICO ratings and financial record. Numerous Local American borrowers might have contemporary records or lower financial assessments, which can make it challenging to meet all requirements for customary loans. Be that as it may, the Section 184 program’s adaptable endorsing permits these people to fit the bill for a home loan, regardless of whether they meet the rigid credit prerequisites of customary moneylenders.

Competitive Premium Rates: In light of the fact that the loan is government-upheld, borrowers can frequently get more good financing costs than they would with a standard mortgage. Banks will offer lower financing costs on the grounds that the public authority ensures the loan, which decreases their gamble.

No Private Home loan Protection (PMI): Dissimilar to typical mortgages that expect borrowers to pay private home loan protection (PMI) in the event that they have an initial installment of under 20%, the Section 184 loan doesn’t need PMI. This can bring about huge investment funds for borrowers over the existence of the loan.

The mix of wretched installments, adaptable credit prerequisites, and cutthroat financing costs makes the Section 184 loan a brilliant choice for Local American families hoping to purchase a home. It gives a pathway to homeownership that is both reasonable and open.

Related Article: 184 Tribal Loan

How to Apply for a Section 184 Tribal Loan?

Applying for a Section 184 Tribal Loan is like applying for different sorts of home loans, however there are a couple of extra advances you’ll have to follow to guarantee that you qualify. Here is a bit by bit manual for assist you with exploring the application cycle.

Step 1: Confirm Eligibility

The initial step is to check that you’re qualified for the Section 184 program. You’ll should be an individual from a governmentally perceived clan or qualified Local Hawaiian. Moreover, guarantee that the property you’re keen on buying is situated in a qualified region. The program is accessible cross country, yet certain properties or areas might require extra documentation.

Step 2: Pick a Taking part Lender

Not all moneylenders are supported to offer Section 184 loans, so you’ll have to track down a partaking bank. HUD gives a rundown of endorsed loan specialists on their site, and large numbers of these banks have experience working with Local American borrowers. Picking the right moneylender is significant on the grounds that they will direct you through the application interaction and assist you with grasping the particular prerequisites of the Section 184 loan.

Step 3: Assemble Required Documentation

Likewise with any home loan, you’ll have to accumulate different reports to finish your application. These may incorporate confirmation of tribal enlistment, work check, bank proclamations, assessment forms, and some other monetary archives the loan specialist requires. Be ready to give extra documentation on the off chance that you’re buying property on tribal land or on the other hand assuming your loan is essential for a lodging improvement project.

Step 4: Present Your Application

Whenever you’ve picked a moneylender and accumulated your documentation, you can present your application. The moneylender will audit your monetary data and check your qualification for the Section 184 program. The endorsing system might take some time, particularly on the off chance that you’re buying property on tribal land, which might require extra lawful advances.

Step 5: Close on Your Loan

After your application is endorsed, you’ll continue on toward the end cycle. At shutting, you’ll sign the fundamental archives, pay your initial installment, and conclude the acquisition of your home. When the loan is shut, you’ll start making installments on your Section 184 loan, and you’ll formally be a mortgage holder.

Applying for a Section 184 loan can take time, however with the assistance of a proficient moneylender, the interaction is direct. Make certain to ask your moneylender any inquiries you have en route to guarantee that you figure out your obligations as a borrower.

The Section 184 Tribal Loan program has made the way for homeownership for huge number of Local American families across the US. By offering reasonable, adaptable funding choices, this program has engaged people and clans to put resources into their prospects and construct more grounded networks. Whether you’re hoping to purchase your most memorable home, renegotiate a current home loan, or foster lodging on tribal land, the Section 184 loan offers a pathway to homeownership that is open and reasonable.